In bull markets, we focus on trading leading stocks because they present the largest profit potential in the shortest period of time.

In bull markets, we focus on trading leading stocks because they present the largest profit potential in the shortest period of time.

But what you may not realize is that, when broad market conditions turn overly bearish, those same leading stocks typically become the best stocks to sell short because they eventually assume the new title of former leading stocks.

In this article, I will show you 3 steps, based on multiple timeframe analysis, to determine whether or not a particular market leader is primed for making money on the short side.

But first, let’s take a quick look at recent market action to confirm the bears remain in control going into the new week.

Highest Volatility In 3 Years

Stock market volatility really picked up last week, with the Nasdaq Volatility Index ($VXN) pushing above 30 for the first time since late 2011.

Since late 2012, $VXN levels in the 20 to 23 range have produced trade-able bottoms on the long side, but last week’s spike was such an extreme move that it suggests the potential for further downside in the broad market.

At the very least, a test of last week’s lows seems probable in the coming days.

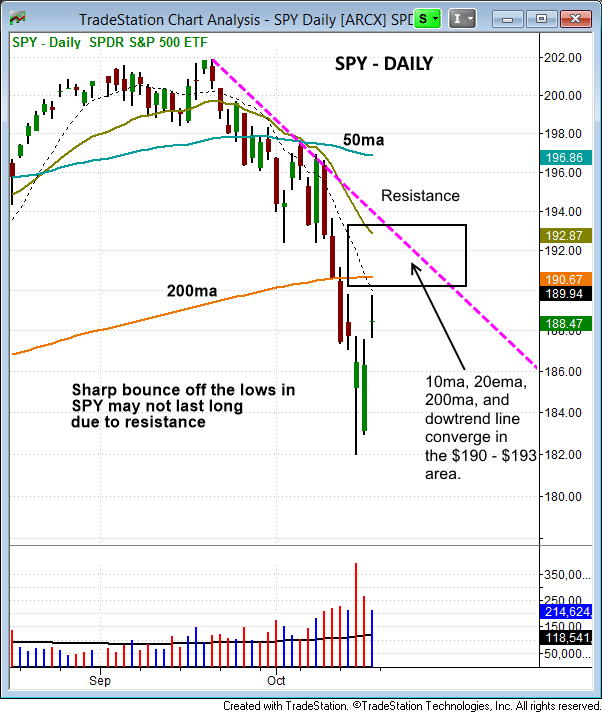

Although the S&P 500 has already bounced 4% off its recent swing low, the benchmark index is now closing in on a major area of resistance.

On the daily chart below, notice how the prior swing low (from mid-August), the 20 and 200-day moving averages, and short-term downtrend line all converge in the $190 to $193 area:

It’s a similar technical picture with the Nasdaq, Dow, and other major indexes, each of which now have a plethora of overhead resistance levels to contend with.

Because market volatility was at extreme levels last week, there was no reason to enter long positions in hopes of catching a short-term bounce in the market, as such speculative trades could easily turn sour in a heartbeat.

Sell Short Former Market Leaders That Look Like This

3D Systems Corp ($DDD) is a great example of the qualities we look for when short selling former leading stocks.

As always, we analyze the chart pattern on multiple time frames, beginning with the monthly chart, then zooming in to the weekly and daily chart intervals.

Step 1

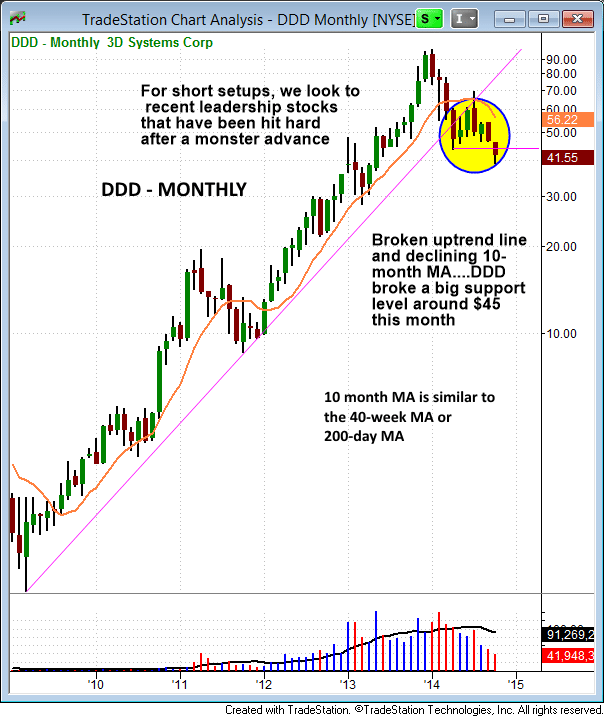

The first step is to assess the “big picture” of the trend by checking out the monthly chart.

Upon doing so, notice that $DDD has registered an incredible advance of more than 5,000% since the lows of 2009.

Even since the the $10 price level in 2011, $DDD rallied about 900% before forming a top at the beginning of this year.

A stock that scored such massive gains (and has already formed a top) is exactly the type of move we look for on the short side:

When a strong stock eventually breaks down below its long-term uptrend line and the 10-month moving average begins to decline, the stock is in trouble and is placed on our internal watchlist for potential short entry in our momentum swing trading newsletter.

Step 2

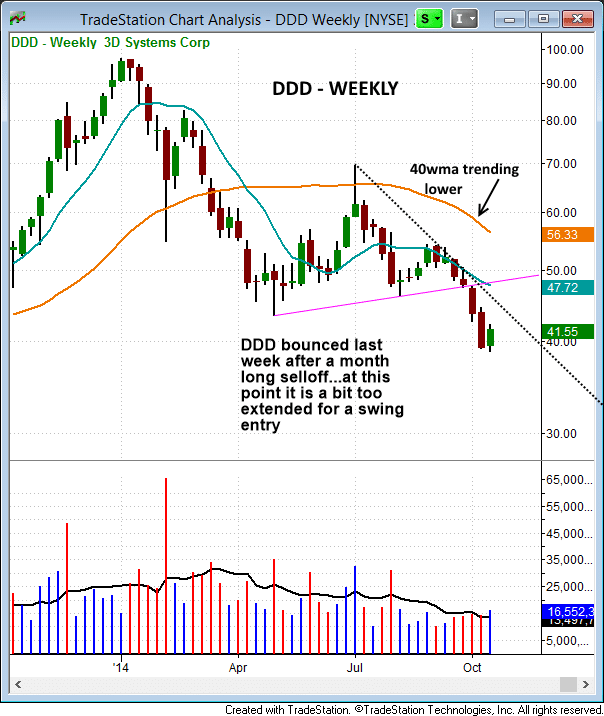

Next, we drill down to the weekly chart to look for confirmation of a bearish pattern as well.

In the case of $DDD, the stock is in a confirmed downtrend because the 10-week moving average is below the 40-week moving average, and both averages are trending lower.

$DDD also recently broke down below a bearish, five-month long base at the lows (read more about bearish consolidation patterns).

The $45 level that was formerly providing support has definitively been broken and will now act as resistance on any rally attempt:

Step 3

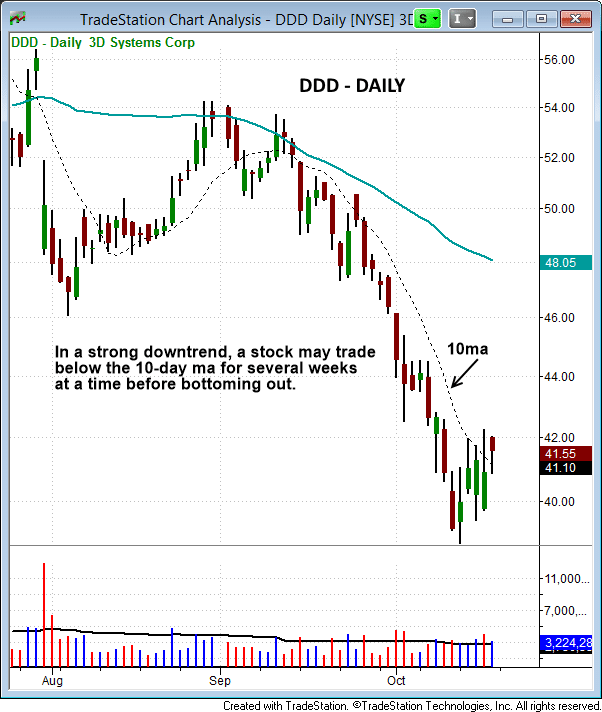

Now that we have identified a former market leader on the monthly chart and confirmed its downtrend on the weekly chart, we finally use the daily chart to help us determine the best short selling entry point.

After a persistent, four-week decline, $DDD is finally bouncing back above very short-term resistance of its 10-day moving average.

In a steady downtrend, stocks can go for weeks without closing above the 10-day moving average for more than a day or two (just as strong stocks remain above their 10-day moving averages in overly bullish conditions):

Patience, Grasshopper

As we have written about in the past, patience to wait for a proper entry point on the short side is crucial; poorly timed entries on the short side are not forgiving.

Although the monthly, weekly, and daily charts of $DDD are clearly bearish, this former leader is presently not a low-risk short entry.

Rather, the most ideal entry point would be a bounce into new resistance of the 50-day moving average and/or prior lows from August ($46-$48 area).

Nevertheless, because the stock remains in a strong downtrend, price action could simply resume lower after just a one-day close above the 10-day moving average.

In this scenario, a move below the October 17 low could be a short entry trigger, while using a tight stop above the two-day high.

$DDD is not yet an “official” short setup for us, but we will immediately notify subscribers of our exact entry, stop, and target prices if/when we sell short $DDD (click here to start your risk-free trial subscription today).

How Long Will This Market Correction Last?

Despite what popular news outlets such as CNBC might have you believe, nobody is able to predict the market’s next move with 100% accuracy (but imagine if you could).

Despite what popular news outlets such as CNBC might have you believe, nobody is able to predict the market’s next move with 100% accuracy (but imagine if you could).

Nevertheless, astute traders paying attention to technical signals typically have the upper hand.

Every market pullback is different, but the current correction feels much heavier (in terms of participation to the downside) than any other pullback in 2013 or 2014.

Throughout most of the past two years, pullbacks were fairly quick because traders were waiting to buy the dip.

Sure, there were plenty of ugly distribution days in 2013, but it was more a case of sector rotation out of extended groups and into new bullish patterns (rather than flat-out selling across the board).

This time around, there have been plenty of distribution days over the past six weeks, but there has been little to no rotation of money into new leaders.

Trade What You See, Not What You Think

Regardless of your view on recent broad market action (whether it’s better to buy or sell), there now are very few stocks with bullish chart patterns; this objective fact cannot be ignored.

Regardless of your view on recent broad market action (whether it’s better to buy or sell), there now are very few stocks with bullish chart patterns; this objective fact cannot be ignored.

Eventually, stocks will manage to find some traction and establish higher swing lows.

But for now, its best to avoid the long side.

With our market timing model in “sell” mode, odds of a profitable trade favor the short side of the market.

Depending on how much the market bounces from here, we may look to establish one or two new short positions into resistance (remember we prefer to short stocks on a bounce).

If you are prohibited from selling short (such as with an IRA account), or are simply not comfortable selling short, no problem!

Inversely correlated “short ETFs” are an excellent, alternative way to gain short-term bearish exposure without actually selling short.

We will be highlighting the best-looking short ETF setups in a future article, so be sure to follow our blog for updates (enter your e-mail address on the top right side of this page).

If you enjoyed this article, spread the love by sharing with your favorite social network.

Nice, Informative blogs. I read full blog this is an awesome blog post. This blog clears my some trading related problems. Thanks for sharing again.

Glad you enjoy our articles. Thanks for visiting.

After a day like today, are you thinking we are in an overbought area now, and still should sell of shortly and test last weeks lows?

Awsome and very informative post, please keep up your good work! 😀

Thanks

Is there a problem with stock screener? I am not able to see charts, used different browers etc. it gives an error code message.

Hi Peter,

Yes, we just sent out an email stating that the screener was in the middle of a major data upgrade, which unfortunately has left the data a little murky.

However, data is updated for most exchanges at this moment, and the auto-updating is starting to work again too.

Buying and selling stocks is a very difficult task.But once we find a good stock recommendations then we can get good amount of returns. So always prefer accurate stock advice to make big profit in market.