With the S&P 500 nearly unchanged since it started the year and the NASDAQ Composite down about 6% year-to-date, 2016 has not been shaping up to be a good one for “buy and hold” investors.

However, for savvy swing traders who have been sticking to their trading strategies, there has still been a steady flow of profitable momentum trading opportunities in stocks showing relative strength to the broad market…if you know how to find them.

One such example is our recent short-term swing trade entry into semiconductor stock Maxlinear ($MXL), which netted an average price gain of roughly 9% with a holding period of just a few weeks.

Invest just a few minutes of your time to continue reading and we will clearly show you how we did it with an educational, technical walk-through of the trade that we recently profited from in the model portfolio of The Wagner Daily.

Stalk Your Prey, Then Wait

With a strong relative strength ranking and impressive earnings/revenue growth over the past several quarters, $MXL has been one of the “must own” stocks for our style of trading, which can be described as intermediate-term trend following.

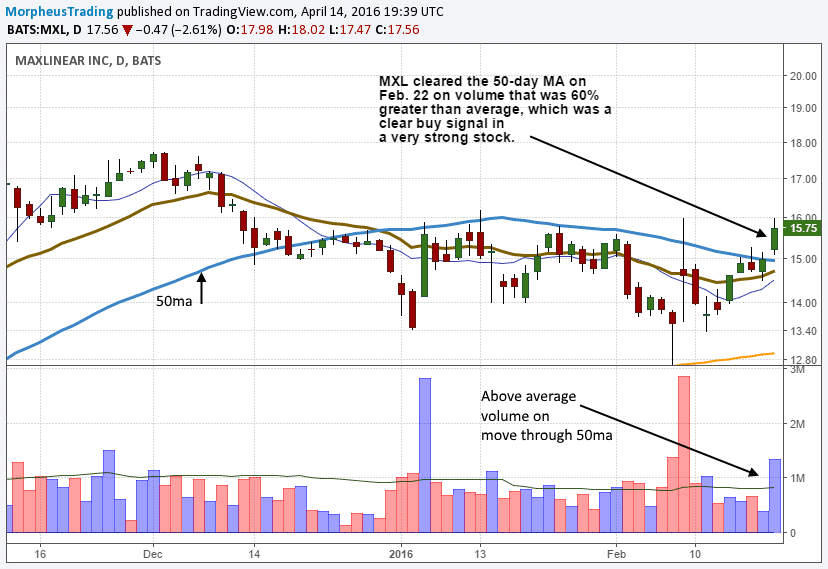

But even the best stock pick needs to be entered with the correct timing, and that time presented itself to us back on February 22.

That day, $MXL broke out above multi-month resistance of its 50-day moving average on heavier than average volume, which was the last condition needed to generate our buy signal in this stock. Here’s what the daily chart looked like at the time:

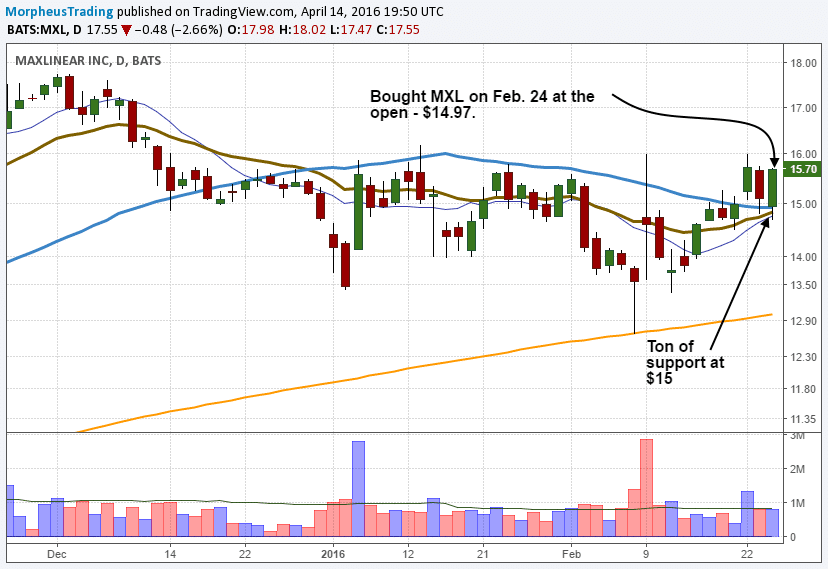

Rather than chasing the price action after the 5% gain of February 22, we patiently waited for a short-term pullback to new support of the breakout level.

Fortunately, we didn’t need to wait long, as a pullback to the $15 breakout area came just one day later (February 23).

The pullback created a buying opportunity because there was a ton of new support from the rising 10 and 20-day moving averages, as well as the downtrend line of the consolidation.

The 50-day moving average was also near $15 and beginning to flatten out from its previous decline, which was in place during the prior consolidation phase of $MXL.

So given all the support around the $15 area, along with higher than average volume on the breakout above the 50-day moving average, we felt $MXL offered a rather low-risk entry point on the next day’s open.

As such, members of our stock picking newsletter were alerted to a buy entry on the evening of February 23.

$MXL triggered our buy entry on the next day’s open.

The chart below shows the price action on the day of our buy entry at $14.97:

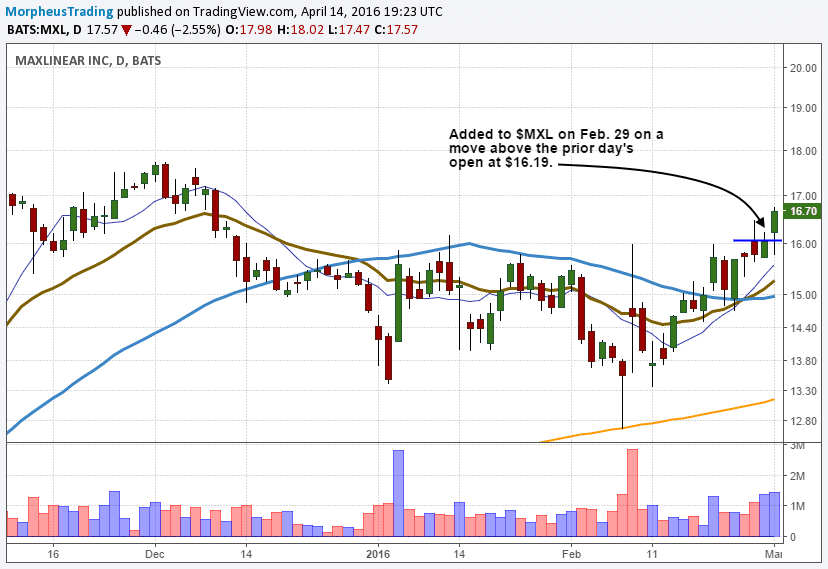

With our entry in the money right away, we added to the position on February 29, as the price cleared the prior day’s open just above $16:

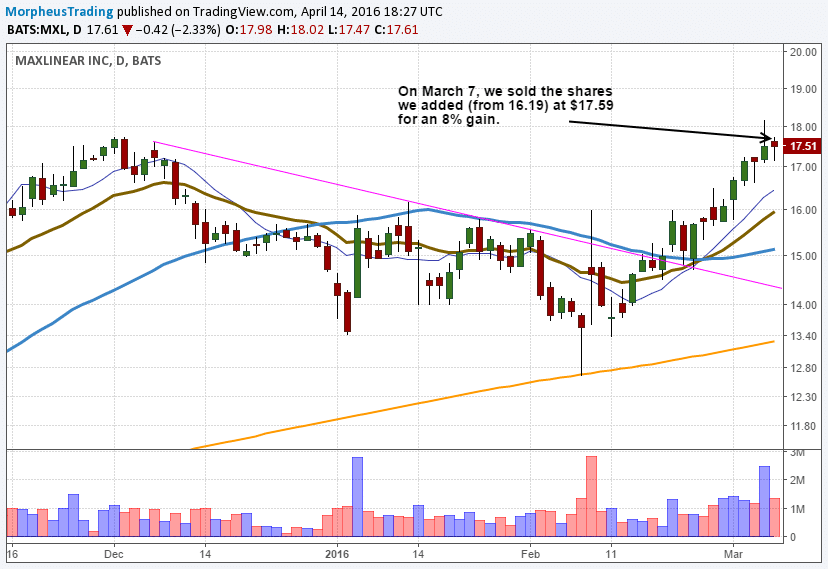

On March 7, we sold the shares that were added on February 29 to lock in some gains because market conditions still were not ideal.

We also kept in mind that we could always buy back the shares we sold…possibly at a lower price on a pullback.

The chart below shows our first exit in $MXL, which netted an 8% price gain in just over one week:

We recently sold the remaining shares of $MXL on May 4, scoring a gain of 10% based on our $16.55 exit in our swing trading report.

We sold due to the heavy volume breakdown below the 50-day MA that occurred on April 19, as well as due to a lack of profit buffer heading into May 9 earnings report.

Conversely, if $MXL would have held the 50-day moving average and cleared resistance at $19, then we would have held the position through the earnings report because there would have been a substantial profit buffer in the event of unfavorable earnings surprise.

What thoughts do you have about this trade? Want to tell us how much you love or hate us? Share what’s on your mind in the comments below and good trading to you!

Taking your wins and losses what is your approximate gain on a yearly basis?

Performance will vary year to year due to market conditions. In general, the potential is there to make 20-40% gains risking a drawdown of no more than 10% of capital. If you want bigger gains, then risking more than 10% of capital is required. I hope this helps. If you need anything else please let me know. Thank you.