Signal generated on close of July 7

Bull market rally. Long exposure can be in the 50 – 100% range or more depending on success of open positions.

Note that the market timing model was not created to catch tops and bottoms in the S&P 500. The model was designed to keep our trades in line with the prevailing market trend. Buy signals (confirmed) are generated when the price and volume action of leading stocks and the major averages are in harmony. This means that we could potentially have a buy signal in a major market average, but if leading stocks are not forming bullish patterns, then we are forced to remain on the sidelines until patterns improve.

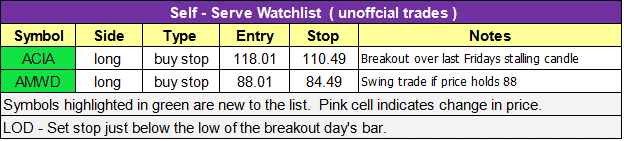

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

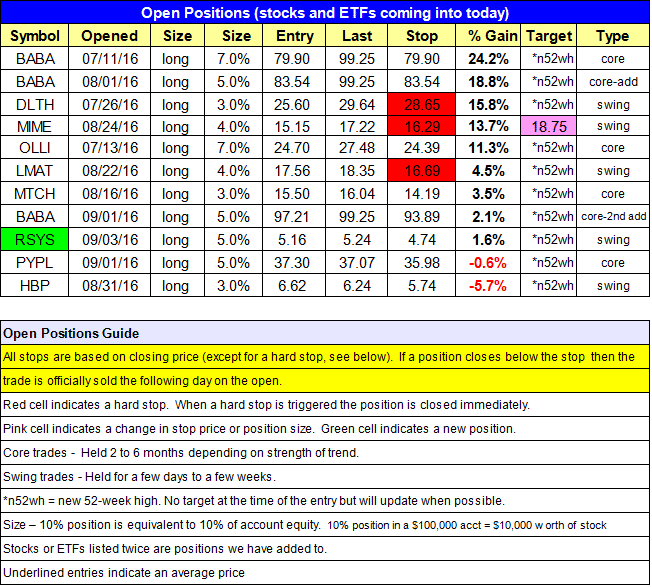

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

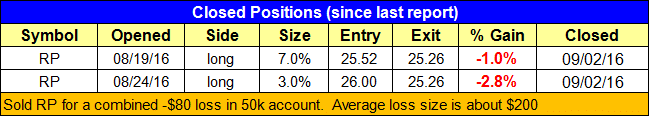

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

position notes:

- $RSYS buy stop triggered. Stopped out of $RP.

Small and mid-cap stocks led the market higher with gains of + 1%, and a close at new 52-week highs for the S&P 400 and Russell 2000. The Nasdaq Composite and S&P 500 gapped higher but failed to follow through, closing with a +0.4% gain.

Late last week’s price action in the $SPY was pretty much by the book, with support coming in at $216 on Thursday, followed by stalling at $219 on Friday. Range-bound it remains.

$RSYS was added to the portfolio last Friday with a solid 4% gain on a pick up in volume. We stopped out of $RP for a combined -$80 loss in our 50k model account. Although the price is holding up, we do not trust the recent price and volume action, or the lack of follow through from our entry.

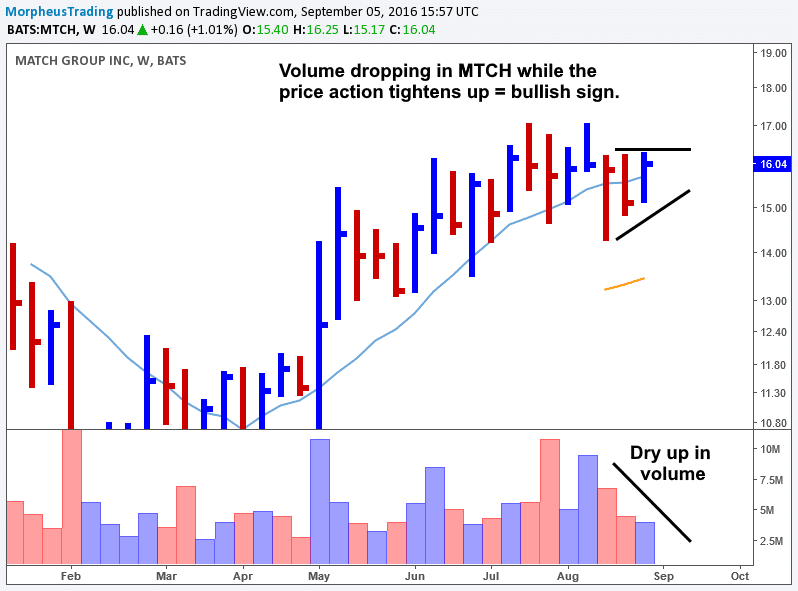

There are no new setups for Tuesday, but we are monitoring $MTCH for a potential add if it can move off the 50-day MA on a pick up in volume.

The volume on the weekly chart of $MTCH has really tapered off the past two weeks, which is a good sign, especially when accompanied by tight price action.

It is currently trading at the IPO highs of 2015, so a breakout above the current range high would be a move to new all-time highs.

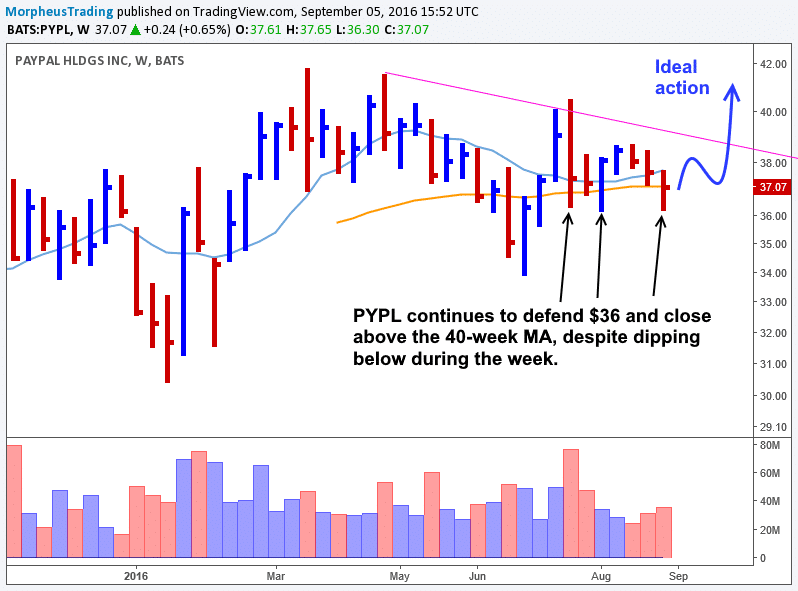

$PYPL is another position we’d like to add to, but will have to show great patience because it isn’t sitting at the highs of its current base, like $MTCH.

The price action once again defended the $36 area last week and closed above the 40-week MA. A weekly close below $36 on volume would be a clear negative here, and would suggest the pattern needs a few more weeks of sideways to lower action before moving higher.

For those not already in with a small 5% position, $PYPL is still buyable.

Please note all the hard stops in the open positions section. Cells highlighted in red indicate a hard stop, which means the position is sold right away when the stop triggers. All other stops are on a closing basis, and are sold the following day after closing below a stop.

This is an unofficial watchlist of potential setups for today’s session (trade results will not be monitored). This list is for experienced traders only who are looking for a few ideas. No targets will be listed. Please check for earnings before entering.

All stops are on a closing basis unless listed as a “hard” stop.