Signal generated on close of July 7

Bull market rally. Long exposure can be in the 50 – 100% range or more depending on success of open positions.

Note that the market timing model was not created to catch tops and bottoms in the S&P 500. The model was designed to keep our trades in line with the prevailing market trend. Buy signals (confirmed) are generated when the price and volume action of leading stocks and the major averages are in harmony. This means that we could potentially have a buy signal in a major market average, but if leading stocks are not forming bullish patterns, then we are forced to remain on the sidelines until patterns improve.

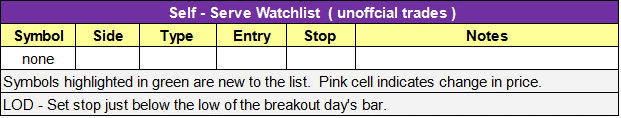

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

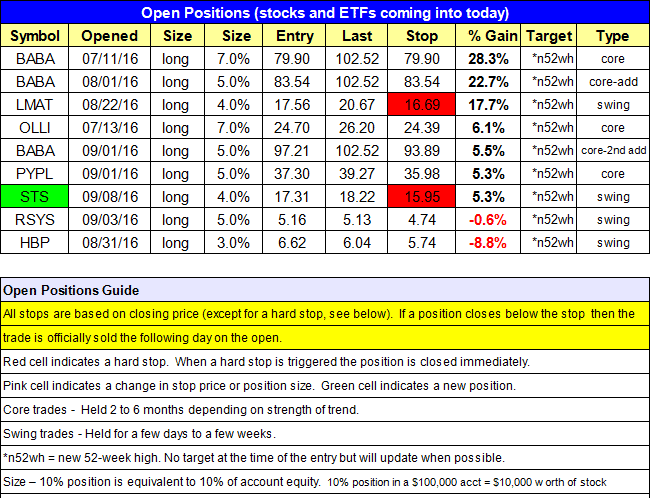

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

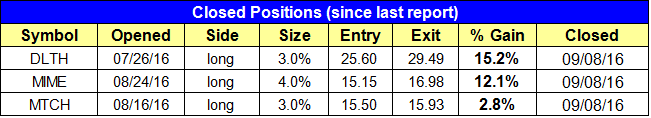

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

position notes:

- Bought $STS. Sold $DLTH and $MTCH on the open. $MIME stopped out just beneath the prior day’s low.

There isn’t much to discuss tonight in terms of broad market action. As mentioned yesterday, the Nasdaq and $S&P 500 are range-bound, while small and mid-cap indices are pushing higher.

The model portfolio was stopped out of $MIME for a 12% gain. Per pre-market email alert, we sold $DLTH on the open for a 15% gain and $MTCH for a minimal 2% gain.

$STS was added to the portfolio on the open and closed at new highs, with a 4% gain on impressive volume.

There are no new setups for tonight. We are monitoring the following stocks for entries on strength or weakness next week: $GIMO $SIMO $GDDY $BUFF $ACIA $DQ $IRBT $CCRC $MBLY $TWLO $TEAM. $GIMO and $SIMO are both forming a stage 2 base after an impressive rally.

To learn about base counts, please pick up a copy of Bill O’ Neil’s “How To Make Money In Stocks”. It is a tremendous book that offers a great deal more than just pattern recognition. The book goes into great detail on how to read what stage a stock is trading in, which gives the market some much needed structure. This book is a must own!

Please note all the hard stops in the open positions section. Cells highlighted in red indicate a hard stop, which means the position is sold right away when the stop triggers. All other stops are on a closing basis, and are sold the following day after closing below a stop.

This is an unofficial watchlist of potential setups for today’s session (trade results will not be monitored). This list is for experienced traders only who are looking for a few ideas. No targets will be listed. Please check for earnings before entering.

All stops are on a closing basis unless listed as a “hard” stop.