market timing model: BUY Signal generated on close of Sept. 21

On a buy signal. It is ok to begin establishing new positions.

Note that the market timing model was not created to catch tops and bottoms in the S&P 500. The model was designed to keep our trades in line with the prevailing market trend. Buy signals (confirmed) are generated when the price and volume action of leading stocks and the major averages are in harmony. This means that we could potentially have a buy signal in a major market average, but if leading stocks are not forming bullish patterns, then we are forced to remain on the sidelines until patterns improve.

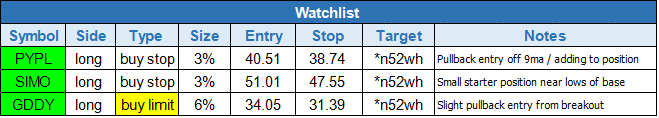

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

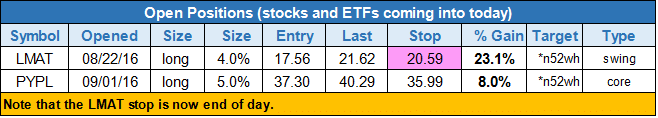

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

position notes:

- No trades were made.

Stocks reacted positively to the Fed’s decision to not raise rates, with all broad market indices up 1% or more.

The Nasdaq Composite gained 1% on higher volume and closed at a new 52-week high (so did the Nasdaq 100).

The S&P 500 is back above the 5 and 10-day MAs, but is still below the 50-day MA and has yet to overtake the high of the ugly selling candle on 9/9.

Wednesday’s rally puts the timing model back in buy mode; however, the S&P 500 must eventually reclaim the 50-day MA to confirm the signal.

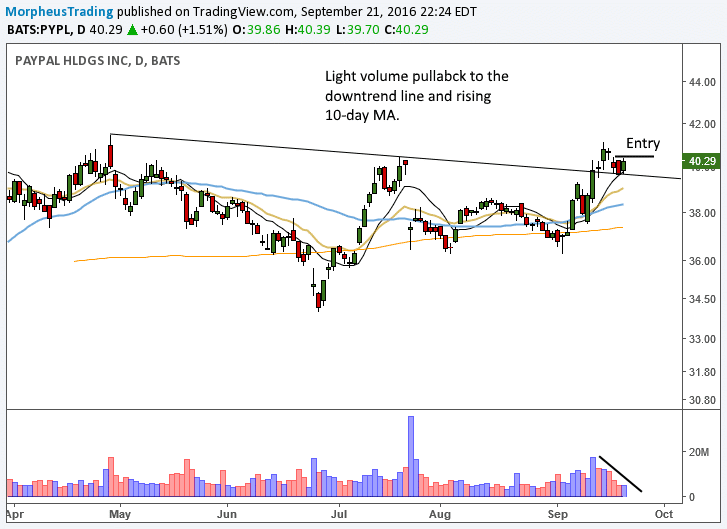

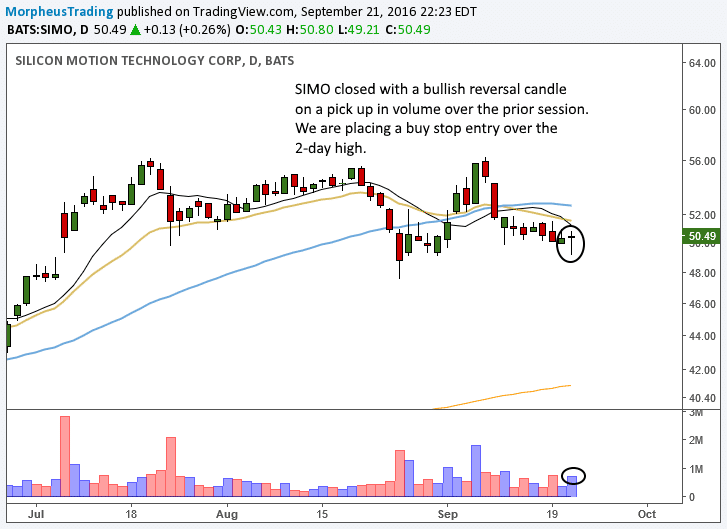

We have three new setups on today’s watchlist in $PYPL, $SIMO, and $GDDY. $GDDY is the lone entry using a buy limit order.

$PYPL has pulled back in on light volume to support of the rising 10-day MA and downtrend line. Our buy entry is over the two-day high with a stop below the 20-day EMA. Look for the volume to pick up on the move out if the setup triggers.

$SIMO formed a bullish reversal candle off the lows of the current base after undercutting last week’s low. Although it may not be ready to move to new highs right away, we are establishing a small 3% position above Wednesday’s high, and will look to add above the 50-day MA.

Note that we lowered the stop in $LMAT to give the action a bit more breathing room around the 10-day MA. If there is a close below our stop then we will exit the following day on the open.

In the short-term, tthe market should avoid printing any distribution days. One may be ok, but 2 or more within the next 5 to 8 sessions would be a negative sign.

This is an unofficial watchlist of potential setups for today’s session (trade results will not be monitored). This list is for experienced traders only who are looking for a few ideas. No targets will be listed. Please check for earnings before entering.

All stops are on a closing basis unless listed as a “hard” stop.