market timing model: BUY Signal generated on close of July 7

Bull market rally. Long exposure can be in the 50 – 100% range or more depending on success of open positions.

Note that the market timing model was not created to catch tops and bottoms in the S&P 500. The model was designed to keep our trades in line with the prevailing market trend. Buy signals (confirmed) are generated when the price and volume action of leading stocks and the major averages are in harmony. This means that we could potentially have a buy signal in a major market average, but if leading stocks are not forming bullish patterns, then we are forced to remain on the sidelines until patterns improve.

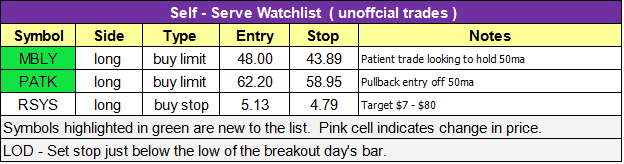

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

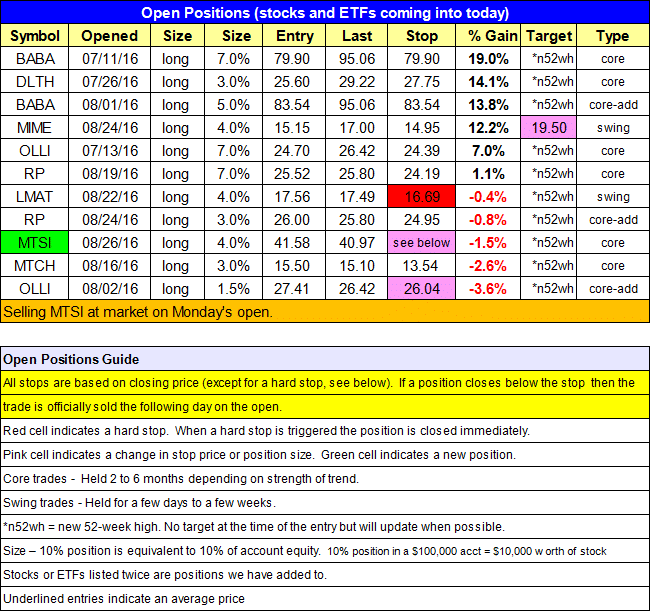

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

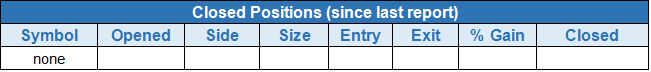

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

position notes:

- Note that we are selling $MTSI on the open.

A late afternoon bounce saved the market from an ugly close at the lows of the week, which would have put major indices under pressure in the short-term. Although Friday’s close was a nice reversal off the lows, the market remains vulnerable to further selling unless it can push through and close above last Friday’s high.

Upon further analysis, we are selling $MTSI at the market on Monday’s open for what should be a very small loss. The high volume stalling on 8/23 is an issue, so rather than stick with the position we prefer to take a small loss and wait for a better setup to emerge.

If you are getting charged too much for transactions, then we recommend switching to trade station or interactive brokers for lower costs and better execution.

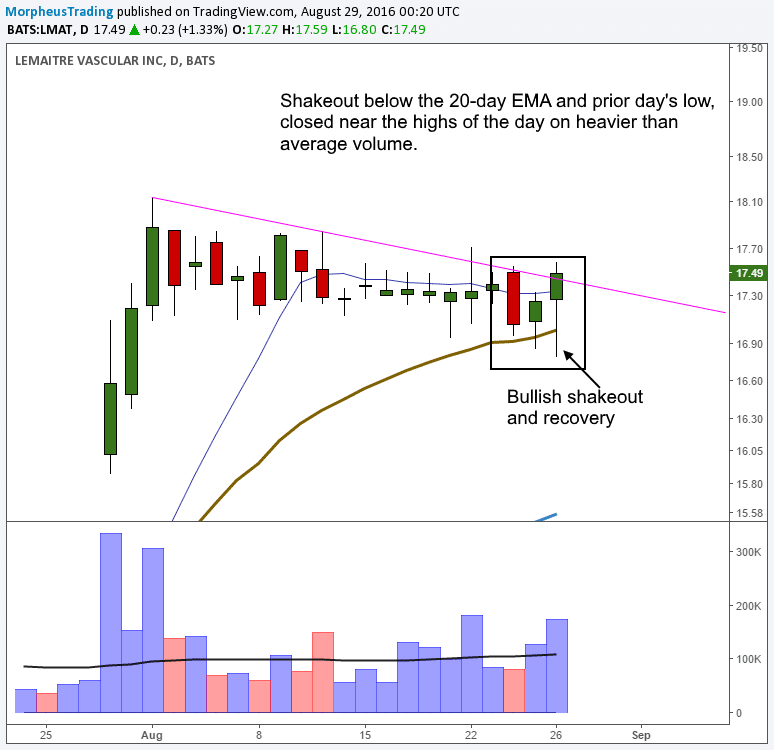

$LMAT closed out the week with a strong reversal candle, undercutting the lows of the week and closing back above the 20-day EMA on volume. The price action should not violate last Friday’s low, as this would invalidate the trade in the short-term.

Raised the stop in $OLLI (on the shares added only) in case it fails to reverse higher heading into earnings this week. Unless $OLLI breaks out, we plan to sell the shares added before earnings this week and hold the 7% position through earnings.

A Monday morning gap that holds above Friday’s high, followed by a move though $18 within a few days would be ideal.

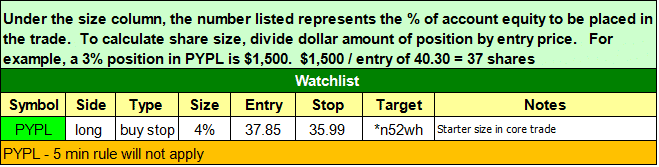

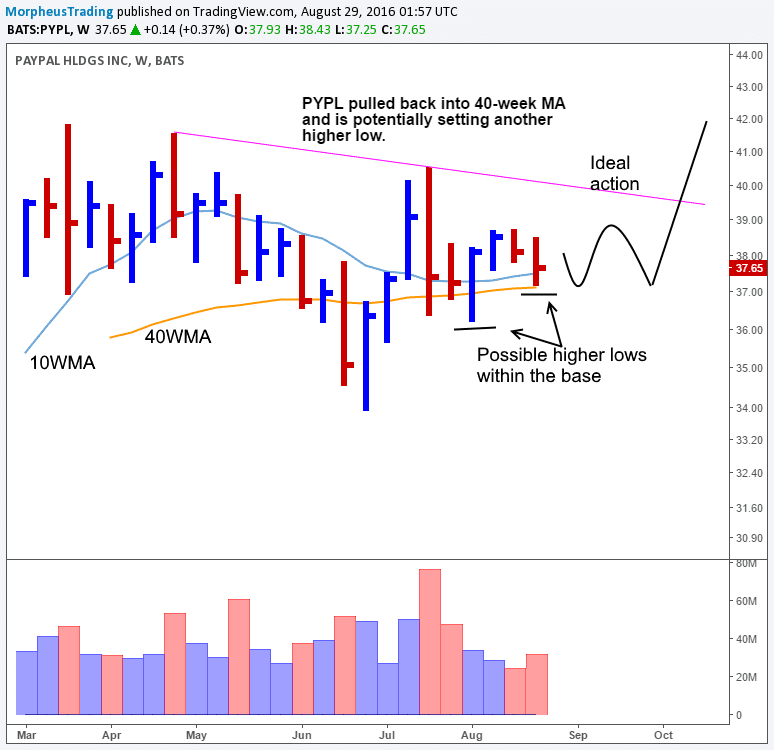

There is one new setup on today’s watchlist in $PYPL, which we are buying with a stop order just above Friday’s close. Basically, we want to get in as close to Friday’s close as possible, so the 5-minute rule will no apply.

After an ugly gap down in July, the price has held the 40-week MA for five weeks while setting higher lows within the base.

We are taking a small starter position with a stop below the recent low on a closing basis. We will have to be patient with this setup, as the price action isn’t expected to move out right away.

This is an unofficial watchlist of potential setups for today’s session (trade results will not be monitored). This list is for experienced traders only who are looking for a few ideas. No targets will be listed. Please check for earnings before entering.

All stops are on a closing basis unless listed as a “hard” stop.