VIEW OUR PROVEN TRACK RECORD OF TRADING SUCCESS

The Wagner Daily newsletter has a long history of proven stock trading profits.

Morpheus has been helping subscribing members earn solid, consistent profits from swing trading stocks and ETFs since 2002. The results of our stock picks and trading signals speak for themselves.

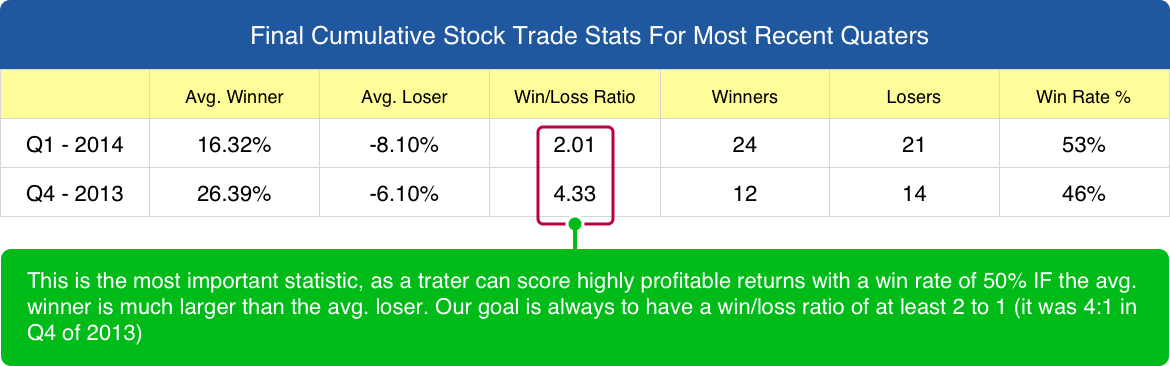

Unlike most stock and ETF trading newsletters and services, we have been publishing the results of every stock & ETF swing trade in our nightly Wagner Daily newsletter since Morpheus was founded in 2002.

Many competing stock picking services hype and promote only their winning stock picks, while conveniently forgetting about their losing trades. Because that is neither ethical nor transparent, we lay out our complete historical trade log of the past 18 years for your review.

Preservation of capital in bear markets

Profiting from swing trading stocks in a raging bull market may not be that difficult because a vast majority of stocks and ETFs will trend higher, alongside of the broad market. However, what separates amateurs from the professionals is the ability to hold on to those profits when the stock market inevitably and swiftly changes direction.

Overall, the combination of our proven trading strategy and market timing system is designed to help subscribers generate consistent trading profits in flat to uptrending (bull) markets, while protecting capital in downtrending (bear) markets.

Even excluding the winning ETF and stock picks and trade signals provided in our nightly trading newsletter, subscribers tell us their Wagner Daily subscription pays for itself many times over just for access to our proprietary market timing model alone.

Our rule-based market timing system, which is designed to keep us out of harm's way during violent bear markets, and even profit through inverse ETFs and/or short selling, is one of the key reasons traders maintain their subscription to our swing trading service over the long-term.

When the big stock market collapse of 2008 occurred, the main stock market indexes plunged roughly 35% or more. However, our stock and ETF picks were still net positive that year because our timing model accurately generated a signal to go to cash and/or selectively sell short.

Notes regarding reporting of swing trades in our cumulative trading log (updated at the end of each quarter):

- Scratch Trades - All ETF and stock trade picks that resulted in a net share price change of less than 1% based on our closing price (both losing AND winning trades) are not included in our cumulative trading log because those trades are considered to be "scratch trades."

- Brokerage Fees - Obviously, every trader needs to pay brokerage commission fees in order to execute trades. While such fees are not accounted for in the cumulative trade log of statistics, commission fees have become so low these days that it nearly becomes a non-issue.

By excluding both winning and losing trades of such a small percentage price change, one can more easily make an accurate analysis of key performance statistics such as our win/loss ratios and avg. gain/avg. loss ratios.

How trading performance results are calculated

Each time a tock pick signal is generated and provided to subscribers, we provide our exact entry point (trigger price) and exit (stop loss price). Additionally, we provide a suggested share size of the trade, based on a percentage of maximum capital risk per trade (100%, 50%, 25%, etc.).

When the swing trade is eventually closed because the stock/ETF hits our target price or stop loss price, we report the percentage price gain of the stock in the next day's newsletter, which is subsequently added to our cumulative log of trading stats here on our website. Note that the results of EACH AND EVERY TRADE is listed, not just selected winning trades. This provides subscribers with the utmost transparency (a rarity in the stock pick and signal provider business).

How much money should I risk on each trade?.

After you become a subscriber to our swing trading service, your actual maximum percentage risk per trade will depend on your personal risk parameters, which must be established before trading. For experienced traders, a safe and typical risk level is 1% to 2% of account equity per trade. New traders should initially risk no more than 0.5% until they become more comfortable with managing risk and following our trading system. Upon becoming a subscriber, you will receive access to our proprietary position sizing calculator to simplify the job of properly determining share size.

We are conservative in our actual trading with real money of our managed accounts, as we personally risk a maximum of 1% of account equity per trade (in our managed account program). In no case do we ever recommend a trader risks more than 3% of account equity per trade because even a brief string of losing trades could quickly cause one to dig a substantial hole that would take a while to recover from.

Above all, we firmly believe in maintaining the same maximum capital risk for each and every trade, regardless of how good any individual trade setup may appear. Traders who "swing for the fences" on any one particular trade can not be successful in the long-term. Rather, consistently profitable traders are successful because they continually work a small mathematical edge on a large number of trades.

Realizing a gain of several percent each month is much better than making 25% one month, but losing 25% (or more) the following month. This conservative approach is the reason we have been consistently profitable and our stock picks have outperformed the main stock market indexes by a wide margin since 2002.

Disclaimer

The hypothetical results presented here do not represent actual trading. Although the performance results and share sizes displayed on this page are from the actual entry and exit prices listed in our trading newsletter (based on realistic execution prices), all performance data presented by Morpheus Trading, LLC is hypothetical and for informational purposes only. Therefore, even if following our system completely, an individual's actual results may vary due to market factors including lack of liquidity, slippage, and commissions.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.No representation is being made that any account will or is likely to achieve profits or losses similar to those reported. At any given time, Morpheus Trading, LLC may or may not have actual positions in the ETF and stock trade ideas presented to subscribers. The goal of our service is for a trader to learn how to properly follow a disciplined trading system and to manage risk in their own accounts.