market timing model: BUY Signal generated on close of Sept. 21

On a buy signal. It is ok to begin establishing new positions.

Note that the market timing model was not created to catch tops and bottoms in the S&P 500. The model was designed to keep our trades in line with the prevailing market trend. Buy signals (confirmed) are generated when the price and volume action of leading stocks and the major averages are in harmony. This means that we could potentially have a buy signal in a major market average, but if leading stocks are not forming bullish patterns, then we are forced to remain on the sidelines until patterns improve.

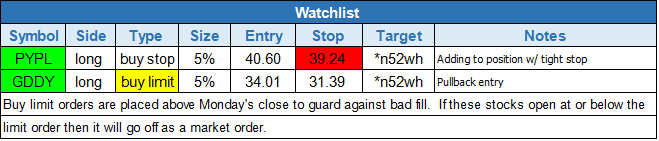

today’s watchlist (potential trade entries):

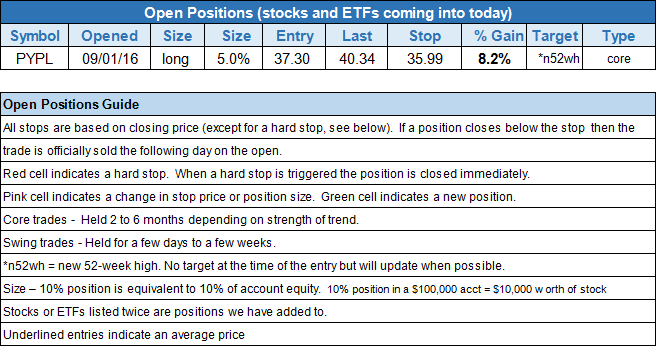

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

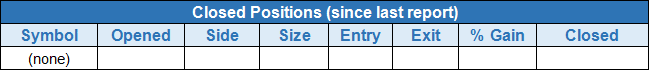

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

position notes:

- $GDEN setup did not officially trigger due to the 5-minute rule. For those who are long, stick with the stop listed in Monday’s report (it is an end of day stop).

- Canceled the $SIMO buy setup for now.

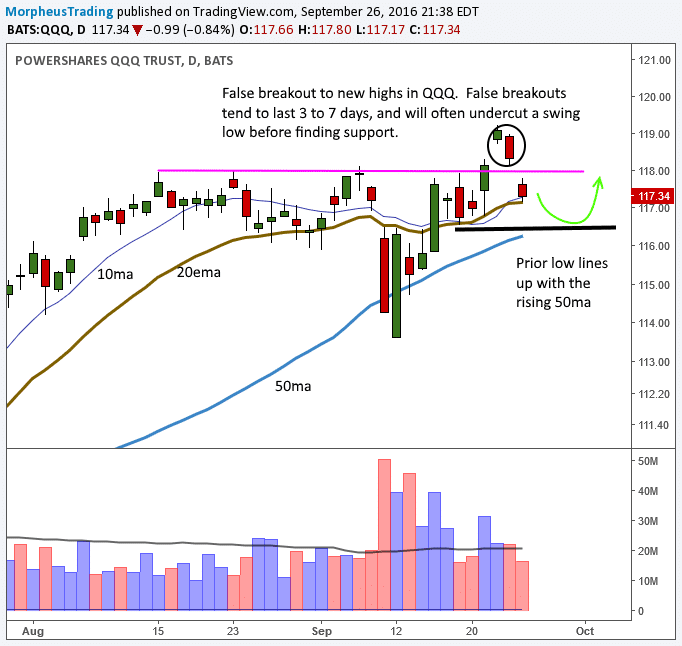

The market opened about -0.5% lower Monday morning, producing a false breakout to new highs in the Nasdaq 100 and Nasdaq Composite.

Generally speaking, false breakouts tend to produce a three to seven bar pullback off a high, with the low of the pullback often undercutting a recent swing low or obvious low (to run stops).

The daily chart of $QQQ below shows the false breakout action which held at support from the rising 20-day EMA. However, if Monday’s low fails to hold within the next day or to, then a test of the 50-day MA is likely, which would undercut the last hourly swing low around $116.50.

With Monday’s false breakout in the Nasdaq, all indices are once again trading in a range. Predicting the day to day movement of the market isn’t what we are about, so until the averages are once again in trend mode we may have to operate with tight stops and keep exposure light. That being said, we still want to add new positions if/when low risk setups develop in top quality names.

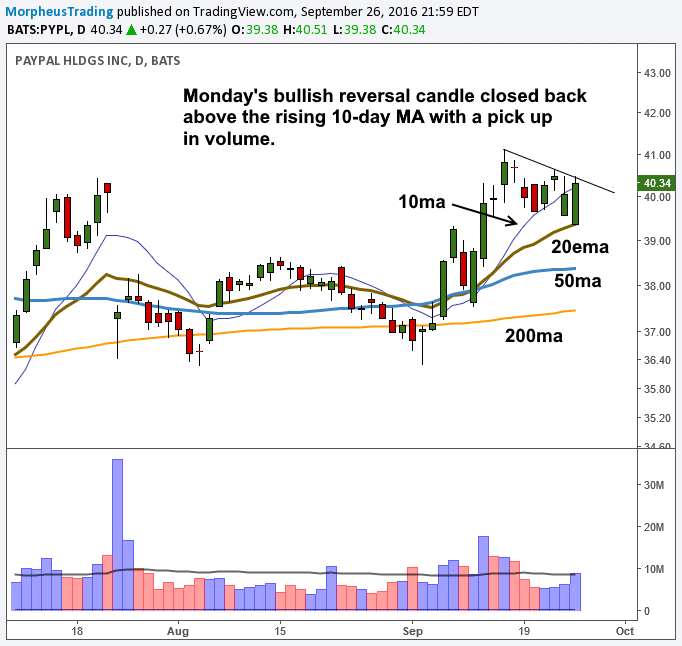

We have two new buy setups on today’s watchlist. The first is an add to an existing position in $PYPL over the high of Monday’s bullish reversal candle, which opened lower but closed near the highs of the day and above the 10-day MA. The price action should not dip back below Monday’s low if it is to remain healthy in the short-term, which allows us to set a tight stop beneath Monday’s low (minimal risk). Note that the stop is highlighted in red, which means that it is a hard stop.

We do not have a chart for $GDDY because we posted one yesterday, but we are basically attempting to enter near Monday’s close using a buy limit order. We really like the dry up in volume the past two days with the price closing above the rising 10-day MA on Monday.

If the price action fails to hold the 10-day MA, then there is quite a bit of support at $33. Our stop is pretty loose, placed below the 50-day MA to allow for some wiggle room. If the $GDDY entry triggers, then we make look to add to the position with a tight stop if possible.

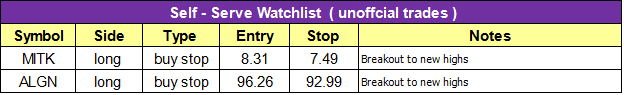

Here are a few other stocks we are monitoring this week: $MTCH $MTSI $ETSY $TWTR $MITK $FOXF $LMAT $ACIA $TPIC $TWLO $YRD $GIMO $RP $USNA.

Please visit the members area of our site to access this week’s relative strength watchlists.

This is an unofficial watchlist of potential setups for today’s session (trade results will not be monitored). This list is for experienced traders only who are looking for a few ideas. No targets will be listed. Please check for earnings before entering.

All stops are on a closing basis unless listed as a “hard” stop.