market timing model: SELL Signal generated on close of Sept. 9

Still operating on a sell signal. However, one can still be long stocks that have held up well if operating with a longer time frame.

Note that the market timing model was not created to catch tops and bottoms in the S&P 500. The model was designed to keep our trades in line with the prevailing market trend. Buy signals (confirmed) are generated when the price and volume action of leading stocks and the major averages are in harmony. This means that we could potentially have a buy signal in a major market average, but if leading stocks are not forming bullish patterns, then we are forced to remain on the sidelines until patterns improve.

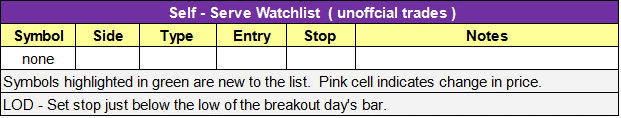

today’s watchlist (potential trade entries):

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

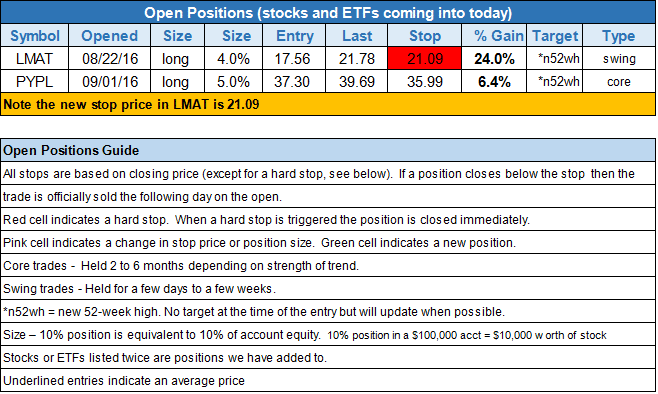

open positions:

Below is an overview of all open positions, as well as a report on all positions that were closed only since the previous day’s newsletter. Changes to open positions since the previous report are listed in pink shaded cells below. Be sure to read the Wagner Daily subscriber guide for important, automatic rules on trade entries and exits.

Having trouble seeing the open positions graphic above? Click here to view it directly on your web browser instead.

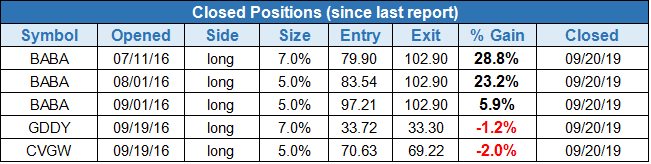

closed positions:

Having trouble seeing the closed positions graphic above? Click here to view it directly on your web browser instead.

position notes:

- Sold $BABA for a 28%, 23%, and 6% gain.

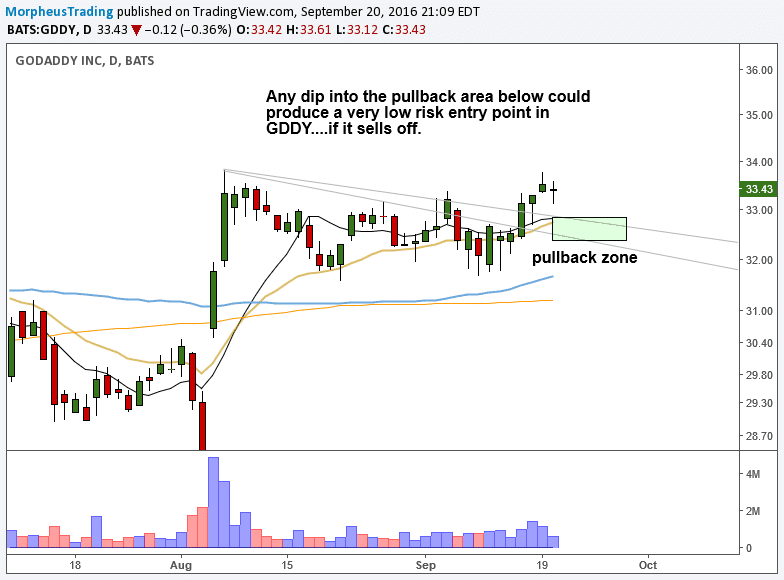

- $GDDY stop triggered for a small loss.

- Sold $CVGW on the open for a small loss.

Broad market indices continue to chop around ahead of Wednesday’s Fed meeting. For those of you who have been with us for a while, you know we do not waste any time thinking about what the Fed may or may not do. We are only concerned with how the markets reacts to the Fed’s decision….so, we should have a better idea about the short-term direction of the market by Wednesday’s close.

The S&P 500, S&P 400, and Dow Jones are the most vulnerable to further selling, as they are trading below the 50-day MA and are close to swing lows. The Nasdaq Composite and Nasdaq 100 still have the 50-day MA as support.

The portfolio took profits in $BABA on Tuesday’s open, locking in a 28%, 23%, and 6% gain on three entries. The total gain for the portfolio was about 3%.

$GDDY and $CVGW were also sold, but both losses were small.

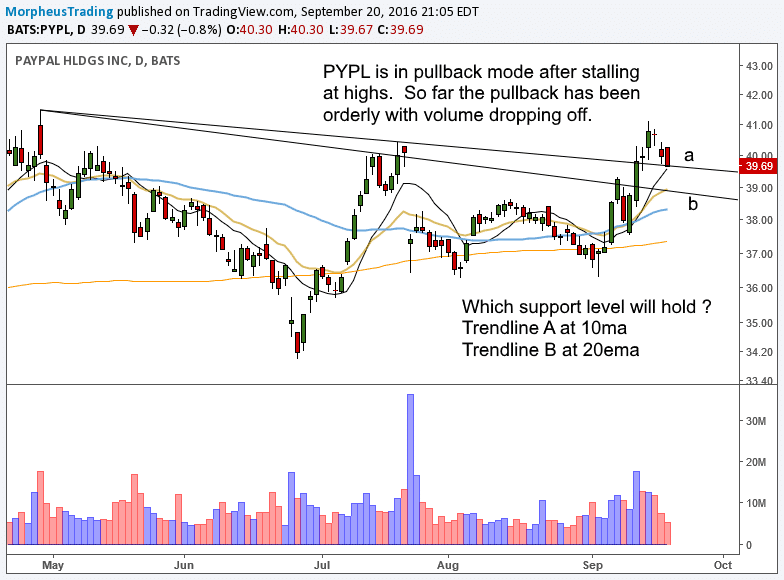

The model portfolio is down to two positions in $LMAT and $PYPL. We have a fairly tight stop in $LMAT to protect a 20% gain. The stop remains pretty loose in $PYPL, and we may have a chance to add to the position on short-term weakness later this week.

Ideally, $PYPL should find support somewhere between the rising 10 and 20-day MAs, in the $38.50 – $40.00 area.

$GDDY is another stock we are monitoring for a potential pullback entry later this week. The downtrend lines and 10 and 20-day MAs should provide support around the $32.50 area.

There are no new setups on the watchlist or self-serve list for today. Let’s sit tight for now and see how the market reacts to the Fed.

This is an unofficial watchlist of potential setups for today’s session (trade results will not be monitored). This list is for experienced traders only who are looking for a few ideas. No targets will be listed. Please check for earnings before entering.

All stops are on a closing basis unless listed as a “hard” stop.