Stock breakouts are about more than simply buying stocks that are trading at new highs. In order for a breakout to be valid and without a high risk of failure, a stock must first possess a valid base of consolidation on its chart pattern.

A base is crucial to an uptrend, as the stock or ETF builds a strong foundation to launch the next advance. Before a stock can launch a big price run up, it must first have a solid base pattern to build upon.

It’s sort of like the foundation for a house; if it’s not solid, the levels above can become unstable. For stocks, base patterns serve as that foundation. They occur when a stock’s price falls, then consolidates over a series of weeks or months. This leads to what is known as a “buy setup.”

Bases typically form after a stock/ETF has already experienced a substantial price increase of at least 30%. That uptrend is important because it shows the stock has already built up a track record of price growth, and has gained support from big institutional investors.

In this article, we will show you how to spot the two top “basing” chart patterns that precede the best breakout buy setups:

- Cup With Handle (Deep Correction)

- Flat Base Consolidation (Shallow Correction)

Study the following chart patterns closely, as they will enable you to develop your eye and eventually read stock charts like a pro.

How To Identify A “Cup and Handle” Chart Pattern

Following are the technical characteristics of a cup and handle pattern, along with an actual visual example:

- The chart pattern must form within an existing uptrend, and stock must be at least 30-40% off the lows. This rule is very important. Do not go looking for cup and handle patterns with stocks trading at or near 52-week lows! The best cup and handle patterns form near 52-week highs. Stocks that are breaking out to new all time highs are ideal because they lack overhead resistance.

- The 50-day moving average should be above the 200-day moving average, and the 200-day moving average should have already been trending higher for at least a few months.

- The base typically forms on a pullback of 20-35% off the highs (deep correction), and is at least seven weeks in length.

- As the base rounds out and the price returns back above the 50-day moving average and holds, be on the lookout for the “handle” to form. The handle usually forms 5-10% below the highs of the left side of the pattern.

- The handle itself should drift lower, and is typically 5-10% or so in width. Handles that retrace more than 15% are too volatile and prone to failure.

- Handles should be at least 5 days in length and not form below the 50-day moving average.

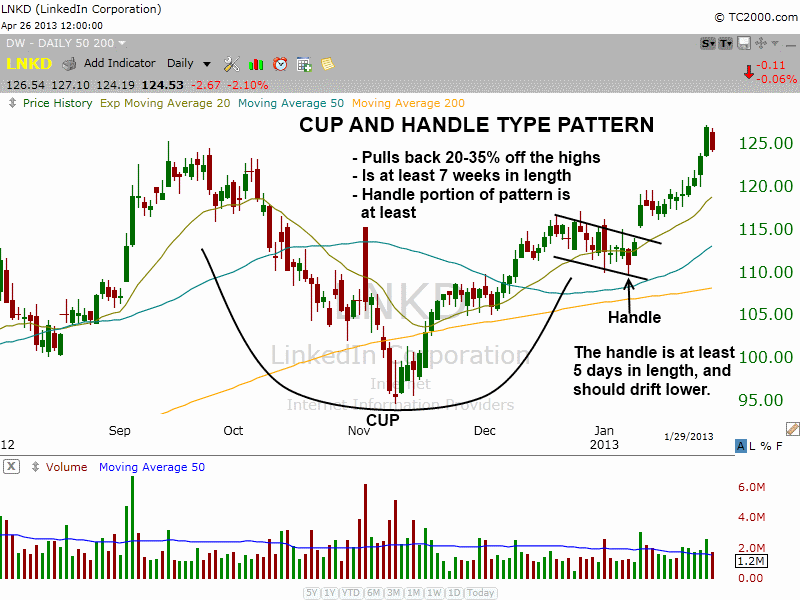

Putting it all together, this chart of LinkedIn ($LNKD) shows a valid cup and handle chart pattern, based on the technical criteria above:

On the chart above, notice the 200-day moving average (orange line) is in a clear uptrend. The 50-day moving average (teal line) is above the 200-day moving average, and the 20-day exponential moving average has crossed above the 50-day moving average.

When the 20-day exponential moving average is above the 50-day moving average, and the price action is above both averages, it is the ideal time for a handle to form.

The key to the handle is that price action should drift lower to shake out the “weak hands.”

The buy point for this type of swing trade setup is a breakout above the high of the handle.

However, over the years, we have learned to establish partial position size at or near the lows of a handle, and add to the position on the breakout above the high of the handle.

This enables us to lower our average cost and provides a better reward to risk ratio.

Check out our simple 10-step checklist to properly identify and trade the cup and handle chart pattern.

Spotting A Flat Base Consolidation

A flat base consolidation is a shallow price correction that should possess the following characteristics:

- As with the cup and handle type pattern, a flat base consolidation must form within an existing uptrend. Typically, it will form after a breakout from a deeper correction (such as a cup and handle).

- The best way to identify a flat base is by using the weekly chart timeframe. The majority of the base should form above the rising 10-week moving average (or 50-day moving average on daily chart).

- The 10-week moving average should be trading well above the 40-week moving average.

- A flat base should be at least 5 weeks in length.

- Flat bases usually correct no more than 15% off the highs

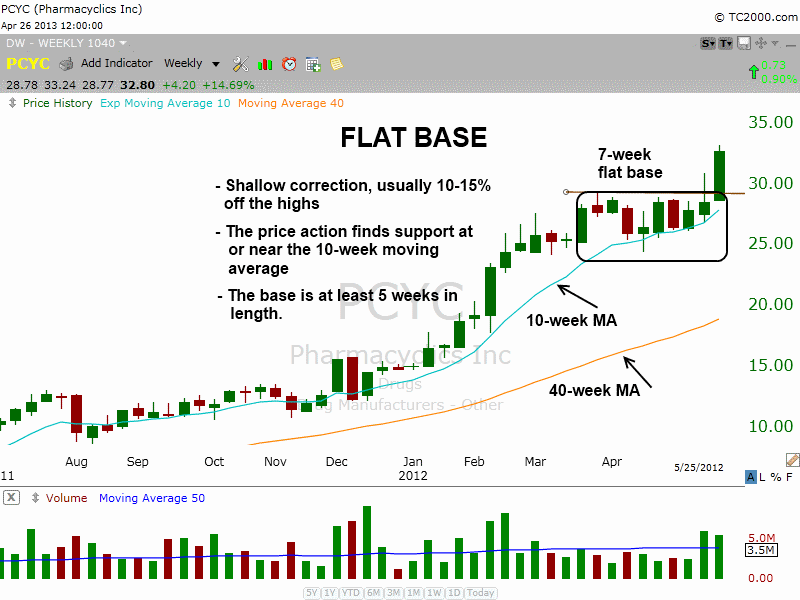

The following chart of Pharmacyclics ($PCYC) illustrates what a flat base consolidation should look like:

Although the weekly chart above is a great example of a flat base consolidation, the pullback was just a bit over 15% at 17%.

Ideally, a flat base should form around 10-15% off the highs, but 16-18% is okay, especially if the stock is volatile.

If the pattern is 25% wide, it is probably not a flat base. Please just use common sense with these rules.

Also on the chart of $PCYC, notice the entire base finds support at the rising 10-week moving average, which is a very bullish sign.

Further, the 10-week moving average is well above the 40-week moving average, and both indicators are in a clear uptrend.

The buy point of a flat base is on a breakout above the highs of the chart pattern.

As with cup and handle patterns, we usually try to establish partial size before the breakout if possible.

Bullish Confirmation Through Tightening Price Action

When finding bullish stock chart patterns, it is crucial to look for a tightening of the price action on the right hand side of the base.

The left hand side is the initial drop off the highs, where the price action cracks and becomes wide and loose.

For the first few weeks, the price action is volatile and there can be quite a bit of selling. But after a few weeks of bottoming action, the stock begins to settle down and push higher.

When the majority of price action is above the 50-day moving average, and the 20-day exponential moving average is above the 50-day moving average, this is when the stock should begin to tighten up.

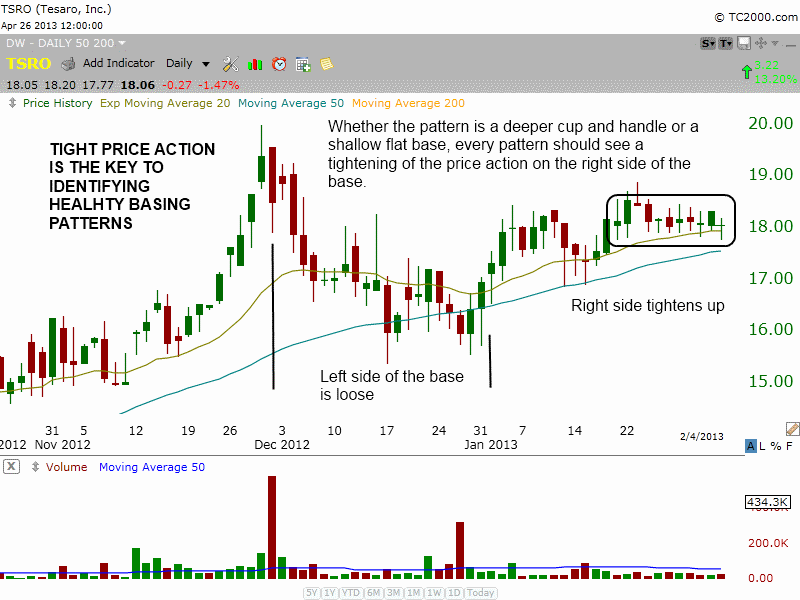

The following daily chart of Tesaro ($TSRO) clearly shows a tightening of the right hand side of the basing pattern:

On the chart above, the initial decline off the highs (around $20) produced volatile price action for several weeks.

However, notice the price action never really broke below the 50-day moving average for more than a few days.

In early January 2013, the price action tightened up. By later in the same month, an extremely tight range develops above the 20-day exponential moving average.

This is a classic snapshot of tightening price action, which is something we always look for.

The most profitable stock picks in our swing trade alerts service nearly always possess the above qualities, so the proverbial proof is in the pudding.

Hello! First, thank you for such a thorough and informative article. Second, I have been following the first training section at Investors Business Daily, which is precisely what you covered. However, the charts you displayed are much easier to read. Where do you get your candlestick charts? I am a young, newbie investor but looking to create a bright future! Thanks for your help!

Hi Lauren,

Our system for stock trading is indeed partially based on the CANSLIM methodology of IBD. However, we have modified the rules slightly so that it is more focused on a shorter-term trading timeframe.

As for the charts, we use several different platforms. Currently, most of the charts you see are from a trading software package called TC2000 by Worden Brothers. If viewing older articles on our site, you will also see charts from e-Signal and TradeStation, both of which also offer solid charting packages.

Hope that helps. Thanks for your comments.

This a great article and very informative. You provide an excellent service to aspiring traders. Technical analysis with a good charting software package / platform is essential to properly assessing the price action and identifying tradable patterns. If you any of your readers have every had a question / concern about how to select the proper chart time frame (who hasn’t had this question at one time, right?), I just posted an awesome article on my FREE trading education and market analysis website (http://www.patterntradinggroup.com/price-charts-time-frames-and-fractals/) that gets right to the heart of the matter once and for all. Keep up the great work! I really appreciate coming to you site and perusing the great material. It’s always educational. .

Hey Kirk,

Thanks for the kind words. Glad you enjoy our articles.

Deron

People having experience of trading can easily find the right stocks to buy, but one who is new to this field will face such problems. I will not be a liar to say that when one is new in such a field, he will face losses once in a while and experience will give them new things to learn.