Paying close attention to strong trends as they develop in leading small and mid-cap momentum growth stocks is the basis to identifying the best stocks to buy for our style of trading.

However, even more crucial than knowing which stocks to buy is understanding the proper timing of when to buy and sell shares for maximum gains, while still keeping risk to a minimum.

Our recent momentum position trade in Mitek Systems ($MITK), which we closed in The Wagner Daily newsletter on May 16 for a whopping gain of 44%, is a prime example of how careful attention to the precise entry and exit points of a trade is your key to major wins.

If you’re serious about trading success, I highly recommend investing a few minutes of your time now to check out the following technical walk-through review of this real stock trade.

Nailing and Scaling In

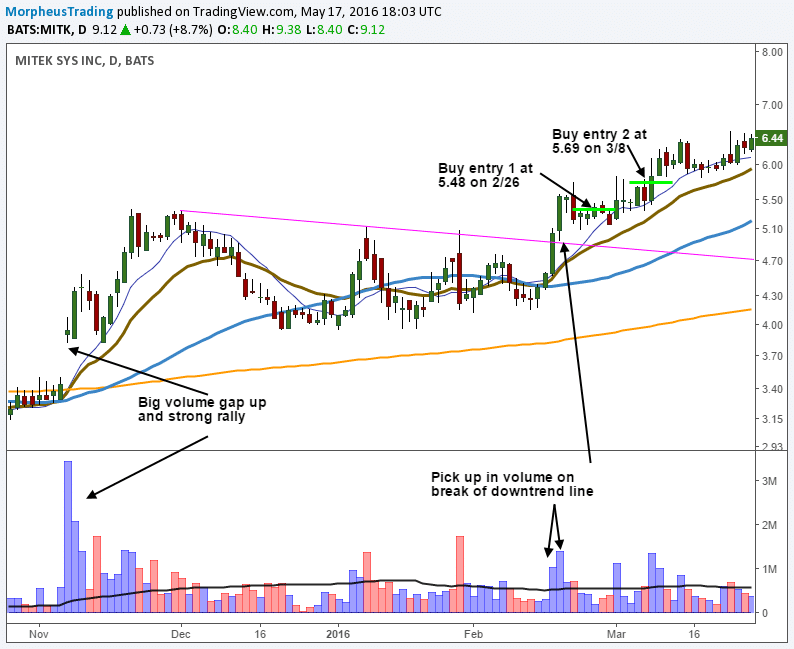

$MITK, a mobile identify verification software company, originally caught our attention last November, when it rallied about 50% higher on strong volume before stalling out around $5.30.

But despite that 50% gain, we still believed the trend was just beginning to heat up and would continue much higher after a few weeks of basing action.

This is because that November breakout was from a long-term 14-month trading range and confirmed by a big spike in volume.

After forming a three-month long base that corrected about 26% off the swing high, $MITK broke the downtrend line of the base on Dec. 17 & 18 of last year on a bullish pick up in volume.

The move out suggested that $MITK was ready to launch significantly higher.

As such, we initially bought $MITK in our nightly stock picking letter on February 26, after a slight pullback that came near support of the 10-day MA at $5.48.

We then added to the position on March 8 at $5.69, as the stock chopped around in a tight range above the 10 and 20-day MAs:

Getting Out Partial

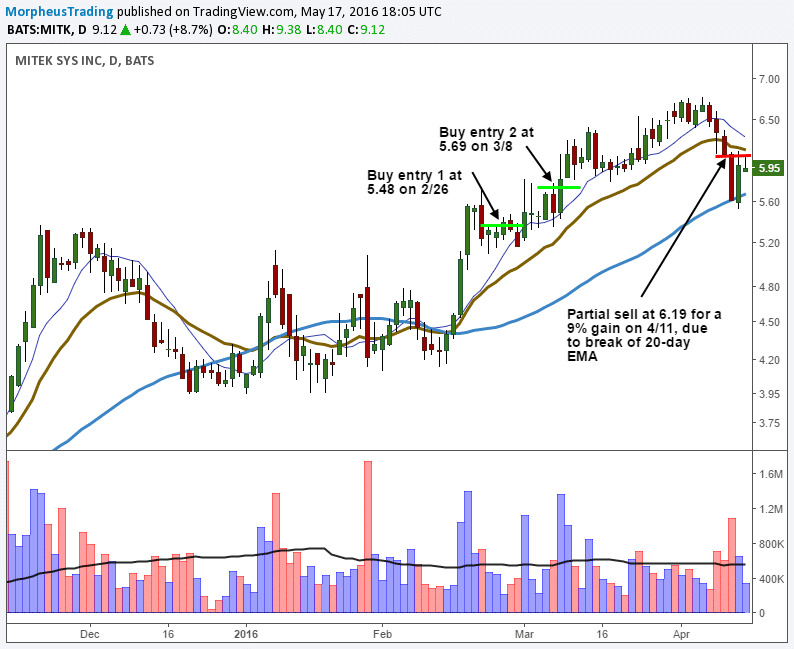

We sold partial size of $MITK for a respectable 9% gain on April 11, as the price action broke the 10-day MA and closed below the 20-day EMA on a pick up in volume.

Anytime a stock breaks the rising 20-day EMA after a decent advance from a base breakout, it is usually a sign that the trend is over in the short-term, so we lightened up to trim our risk:

Fortunately, we continued to hold the remaining position, which perfectly came into support of its 50-day MA, then began rocketing higher in late April.

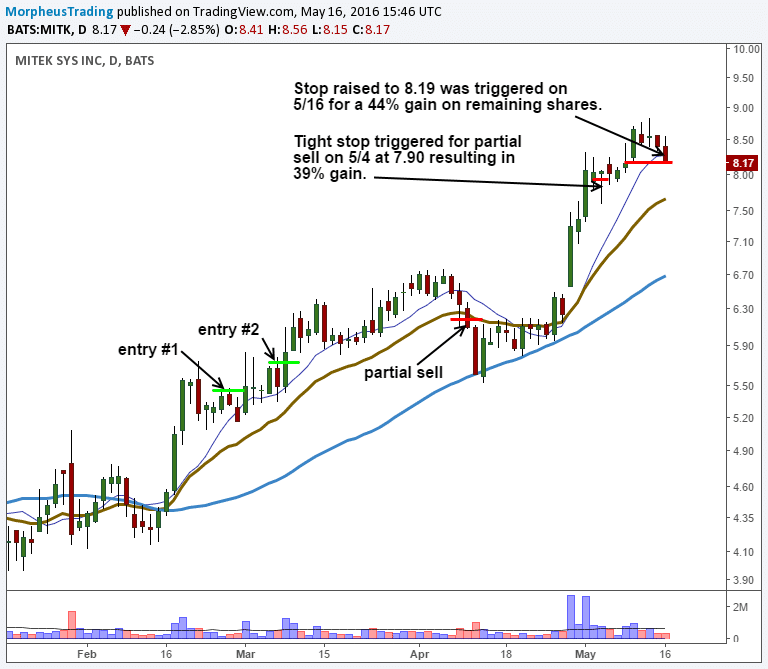

On May 4, our tight trailing stop was triggered at $7.90, locking in a sweet 39% gain on our second exit of partial share size.

Thereafter, we squeezed the stop higher to protect gains and finally sold the remaining shares for a 44% price gain on May 16, as $MITK reversed back below the breakout pivot at $8.33:

As illustrated by the charts above, $MITK is an example of how we manage trades in the hopes of catching a strong trend.

We never know which stock will run the most until it actually happens, which is why we first sold partial size of $MITK for the 9% gain as it broke below support of its 20-day EMA.

However, by only selling partial share size, we were able to stick with the position as it pulled back into the 50-day moving average and resumed its bullish trend higher thereafter.

These types of trends can be very tricky to identify early in the game, but the experience of looking for the same types of chart patterns over and over again eventually trains your eyes to start spotting such patterns more easily.

There are many great tools that can be used to easily identify these trends, and most successful traders use software to determine which stocks to buy.

However, when you subscribe to our swing and position trading report, you will continually see what the best types of trades look like and will begin to adapt your own system that reaps you solid long-term rewards.

Sticking to a system and following it is the name of the game in the business of technical stock trading.

By devising a trading system and sticking with it, you will learn to focus on retaining most of your trading profits, while still eliminating much of the risk of giving it back.

What thoughts do you have about this trade? Want to tell us how much you love or hate us? Share what’s on your mind in the comments below and good trading to you!