Why Stock Market Timing Really Works In Any World Market

Traders and investors of any market in the world who learn to understand the true correlation between the psychology of market momentum and the the direction of market trends will eventually have the ability to master a reliable Stock Market Timing System that consistently enables them to maximize profits in uptrending markets, while minimizing losses when markets suddenly reverse lower. This, of course, is the key to becoming a winning momentum swing trader over the long-term.

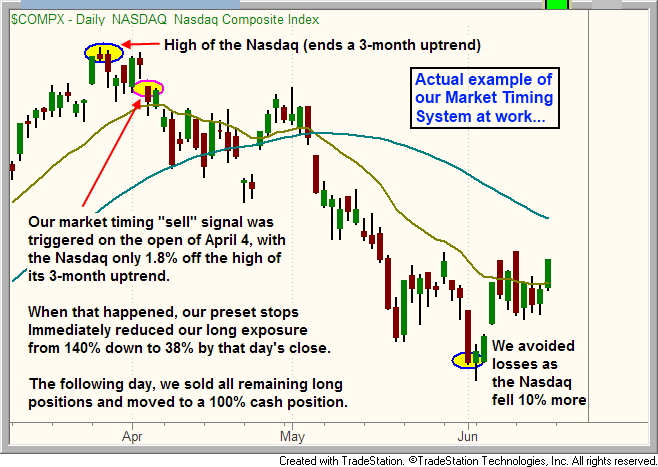

Let’s jump right in and give an actual example of how market timing works by looking at the daily chart pattern of the NASDAQ Composite Index ($COMPQ) below. The annotations represent actual trade signals we presented in real-time to subscribers of The Wagner Daily newsletter during that time period. An explanation of the chart follows below:

As the chart above illustrates, the model trading portfolio of our trading newsletter was carrying exposure of 140% going into late March of 2012 (200% maximum exposure is based on typical 2 to 1 brokerage margin account). On the morning of April 4, our timing model gave us the signal to exit most of our long positions, lowering our exposure to just 38% of capital in the model account. One day later, we sold the remainder of our long positions. This put us into a full 100% cash position…perfectly putting us on the sidelines while the Nasdaq fell another 10% over the next 10 weeks.

Although not shown on the chart above, we subsequently also began entering new short positions on April 20, just in time to catch the Nasdaq’s big breakdown below key support on April 23 (the following trading day). Specifically what prompted us to exit our long positions when we did was a combination of a few proprietary signals we share with our subscribers. Because our broad market timing calls, along with our specific trade entries and exits, are documented every day in our stock and ETF trading newsletter, it is important to realize we are not utilizing any type of hindsight in writing this article (we actually never do).

Many traders subscribe to our winning swing trading newsletter to receive the detailed entry and exit points of our best stock and ETF picks. However, quite a few of our members subscribe only to benefit from our objective, rule-based Market Timing Model (click here for details), which reliably indicates when to enter and exit the market with their own stock trades at the most ideal times (as shown in the chart above).

Now, here is some major “food for thought” that could have a very substantial bearing on the future livelihood of you and your family…

The death of traditional, long-term “buy and hold” investing

For decades, retail investors have been brainwashed into thinking the only way to make money in the stock market was to utilize a “buy and hold” strategy. The pitch was that if you just keep your money in the market when the going gets rough, such as in bear markets, the substantial upside in the good years will more than compensate for the down years, thereby leaving you with a solid annualized gain over long-term. In fairness, that was true for the approximately 20 years leading up to the new millennium. However, in case you been sleeping in a cave in recent years, times have changed.

Our firm opinion is that the geopolitical landscape of the world has changed so much in recent years that we, our children, and our grandchildren will be facing a brave new world economy. Yet, the average financial advisor working at any of the old-line brokerage firms will still insist that the “buy-and-hold” model is not dead, and is the only proper way to invest in the market.

I will take it a step further by saying even financial advisors who actually believe the “buy-and-hold” model will no longer be very effective in the future (at least for the next several decades), will still not tell you otherwise. Why? Because the institutional investors (banks, mutual funds, hedge funds, pension funds, etc.) need to continue perpetuating the myth in order to help promote liquidity in the markets, and in hopes of preventing future market collapses due to panic-fueled selling by the masses when they eventually figure out the actual state of affairs.

This means it is crucial to follow a disciplined, rules-based Market Timing System for determining when to be heavily buying the market, when to get out of the market, and even when to (optionally) sell short. While traditional long-term “buy and hold” investing enables investors to firmly capture solid gains in uptrending markets, the problem is they frequently give back a substantial, or even majority, of their gains when the inevitable corrections come. Furthermore, markets always decline faster than they rise, just as the Dow Jones Industrial Average surrendered 10 prior years of gains in just the 2-year decline from 2007 to 2009.

In general terms, our proprietary, rule-based Market Timing System is designed to:

- Prompt us to exit our long positions within approximately 2% of all significant market tops (in uptrending markets)

- Be positioned mostly in cash during choppy or range-bound markets, with the exception of select ETFs with low stock market correlation

- Be positioned mostly in cash and/or short positions during downtrending markets

- Signal us the proper time to re-enter the market and start buying stocks and ETFs, shortly after the market confirms a significant bottom has formed

- We never try to sell at the absolute top of a rally, nor buy at the absolute bottom. We always look for confirmation that intermediate-term trends have reversed.

But what about just trading the strongest stocks and not worrying about the rest?

Perhaps you’re thinking that if you simply do short-term trading stocks and ETFs with the most relative strength to the major indices, there’s not much of a concern to worry about market timing because these stocks will outperform. To only a slight degree, this is true. If, for example, the stock market is in a confirmed uptrend, and then has a normal, lower volume correction off its highs, leading stocks and ETFs with the most relative strength will generally remain in a holding pattern or possibly continue higher despite weakness in the broad market. This is normal and healthy market action in an uptrend.

However, when a confirmed downward trend reversal begins to take place among the S&P 500, Nasdaq Composite, and Dow Jones (as determined by simple moving average analysis), even the strongest equities will eventually succumb to the weight of the overall broad market’s downward pressure. At this point, it is no longer advisable to be in any positions in the long side of the market because approximately 80% of stocks always move in the direction of the dominant market trend.

This is why one of the first steps of our rule-based technical swing trading system is to clearly identify the dominant direction of the main stock market indexes. Then, we simply switch to trade in the same direction of that trend (or remain heavily in cash in downtrends). This is where our Market Timing System comes into place, as it provides us with the necessary technical signals to give us just the right amount of warning time to indicate when the trend is about to reverse.

So, how can I learn a market timing system that works too?

Having a proper system that times the market and works effectively a majority of the time enables one to hold onto hard-earned stock market profits when market conditions head south, as they always eventually do in part of normal market cycles. Since 2002, we have been using our disciplined, rules-based system for timing the markets, which is one of the reasons we have managed to produce consistent trading profits with the detailed ETF and stock swing trader picks provided in our end-of-day stock newsletter.

If so inclined, one could even study our free archive of past Wagner Daily stock newsletters since 2002 and see that similar defensive action was taken at the right time with most other market tops as well. Also, it is important to understand our trading strategy is not designed to call exact tops or bottoms in the market; rather, our goal is always to “take the meat out of the middle” of a confirmed trend, which enables us to realize the maximum profit with the least amount of risk.

If you are a trader who already has your own list of ETF and stock picks you like to trade, and simply need help with overall market timing, jump to https://www.morpheustrading.com to get started with your risk-free 30-day test drive of our market timing and swing trading newsletter today. We guarantee your complete satisfaction.

What are your thoughts? Is “buy and hold” dead, or merely going to be out of favor for quite a while? Please feel free to leave your comments below.

As the chart above illustrates, the model trading portfolios of our Wagner Daily Newsletter was carrying exposure of 140% going into late March of 2012 (200% maximum exposure is based on typical 2 to 1 brokerage margin account). On the morning of April 4, our timing model gave us the signal to exit most of our long positions, lowering our exposure to just 38% of capital in the model account. One day later, we sold the remainder of our long positions. This put us into a full 100% cash position…perfectly putting us on the sidelines as the Nasdaq fell another 10% over the next 10 months

It looks like the reference to “March of 2012″ …..”perfectly putting us on the sidelines as the Nasdaq fell another 10% over the next 10 months” should reference another year as we are not yet removed 10 months from March.

Hey Tony,

Thanks for catching that error. It was supposed to say “10 weeks” not “10 months.” As you can see on the chart, 10 weeks matches the description. We have made the correction in the article.

Cheers,

Deron

After being burned recently by an advisory service for futures utilizing Gann and Elliott Wave I am thing about your scanning as I am tired of paying for bad advice Once bitten, twice shy, as they say-Does any information come with the scanning data or is that an $80 letter, which I am sure I’d quite good. Just a little skitterish right now, is all.

Hi Gary,

The stock scanner is designed to be a quick and easy way for intermediate to advanced traders to find the best potential breakout and pullback trade setups (. It does NOT include specific guidance on when to buy and when to sell. HOWEVER, a subscription to The Wagner Daily actually includes a subscription to the Stock Screener, and also gives you specific entry, stop, and target prices. A comparison of the Stock Screener versus The Wagner Daily newsletter can be found here.

Also, if you sign up for our Wagner Daily newsletter, there is a 30-day period in which we will refund 100% of your money if you are not happy and wish to cancel. This makes it easy to test drive the service without any commitment.

Please let me know if you have any further questions.

Hi, Deron.

I have two types of accounts: One is IRAs & 401(k) rollovers; the other is a regular cash account. Obviously, short- vs. long-term gains/losses affect the taxes on the cash account. (How) Do you ever take this into account – or give different advice depending on the type of account?

Thanks,

Hi Mike,

Our trading strategy does not take taxes into consideration because we file under IRS Section 475(f) election. This indicates you are considered a professional trader and therefore can simply report a net gain or loss at the end of the year, based on the total sales value less total purchase cost. Short vs. long-term gains/losses are irrelevant in this case. [Disclaimer: Consult a licensed tax professional for details]

Nevertheless, the one way our service helps people who have IRA/401k accounts is by providing inverse ETF trades in bearish market conditions, rather than solely short selling. Since IRAs are non-marginable, they can’t be used to sell short, but inversely correlated ETFs work great in this regard.

Hope that helps.

Cheers,

Deron

Thanks, Deron.

My pleasure.